In today's technologically driven world, seamless transactions are no longer a luxury but a necessity. Google Pay NFC, a standout in the realm of digital payments, offers a revolutionary way to conduct transactions securely and effortlessly. Near Field Communication (NFC) technology underpins this service, allowing devices to communicate wirelessly when in proximity. This simple tap-and-go mechanism has redefined the retail landscape, providing users with a rapid, secure, and convenient way to make payments.

With a simple tap of your smartphone, Google Pay NFC eliminates the need for physical cash or cards, streamlining the purchasing process. It is designed not only for ease of use but also to enhance the security of each transaction. Authentication features such as fingerprint recognition and screen lock ensure that your financial information remains protected.

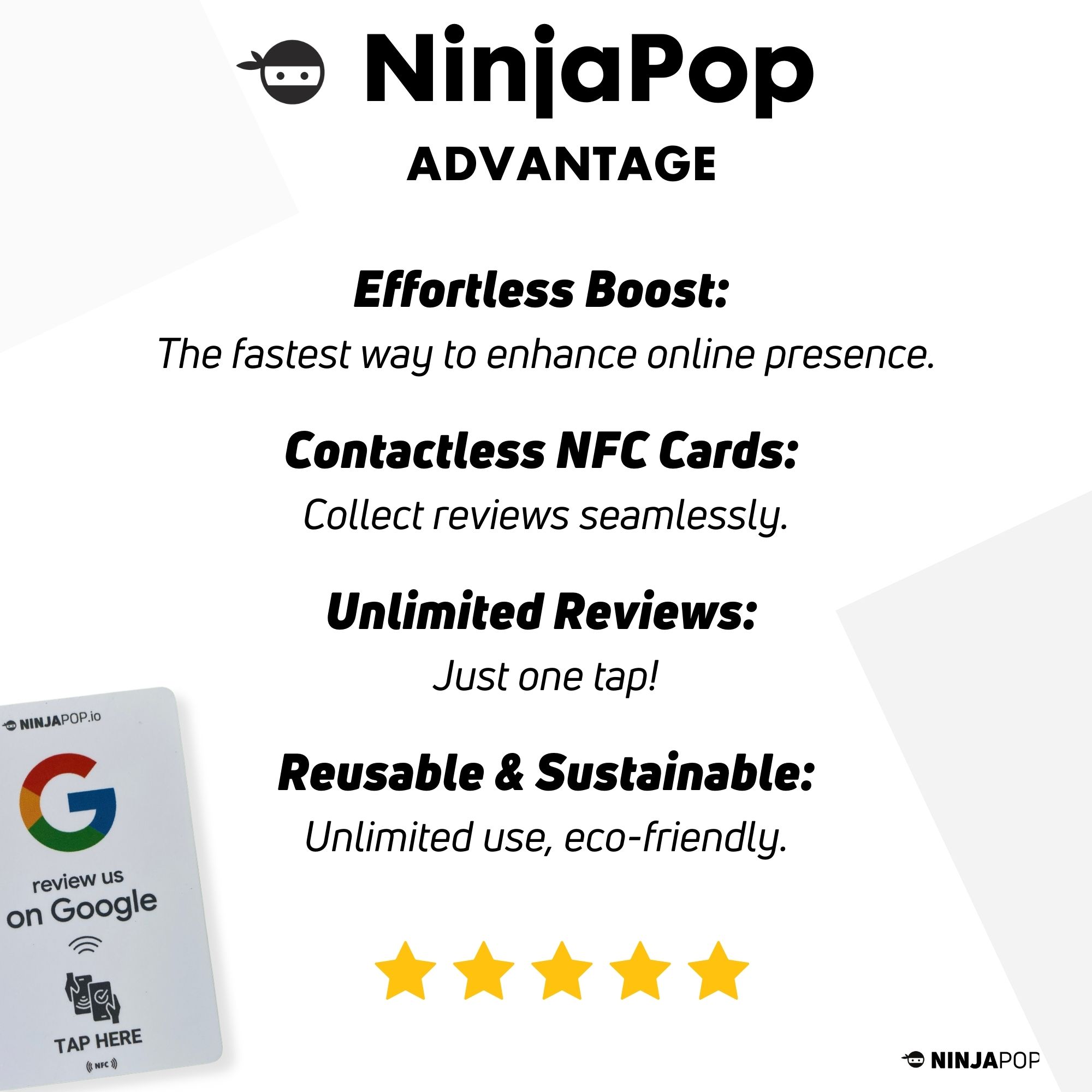

As NFC technology continues to evolve, businesses and individuals alike are embracing this change for its multitude of benefits. For those looking to enhance their online presence and trust, integrating Google Pay NFC with advanced tools like Ninja Pop can be a game-changer. Imagine tapping into a world where every customer interaction is an opportunity to gather positive feedback and reviews. Get your Ninja Pop now! and transform your transactions into powerful endorsements.

Understanding NFC Technology Basics

To grasp how Google Pay NFC works, it is essential to understand the fundamentals of NFC technology. At its core, Near Field Communication (NFC) is a form of short-range wireless communication that enables the exchange of data between devices over a distance of a few centimeters. This technology facilitates direct communication between an NFC-enabled device, such as a smartphone, and an NFC reader or another NFC device.

NFC operates within the radio frequency identification (RFID) spectrum, employing electromagnetic fields to transfer data. One of the standout features of NFC is its ability to support both one-way and two-way communication. In one-way communication, data is transferred from one active device to a passive device, such as when a smartphone reads an NFC tag. Two-way communication, on the other hand, involves data sharing between two active devices, which is the principle behind contactless payments.

What makes NFC particularly appealing in the realm of digital payments is its simplicity and security. Unlike Bluetooth, NFC does not require manual pairing or device discovery, making it exceptionally user-friendly. Furthermore, its short-range nature enhances security, as transactions can only be initiated in close physical proximity, reducing the risk of unauthorized access.

Understanding these basic principles of NFC technology provides the foundation for appreciating the seamless and secure nature of Google Pay NFC transactions, setting the stage for a deeper dive into its practical applications and benefits.

Setting Up Google Pay NFC

Setting up Google Pay NFC is a straightforward process that allows users to enjoy the convenience of contactless payments. To get started, you'll need a compatible smartphone with NFC capabilities and the Google Pay app installed. Here’s a step-by-step guide to set up Google Pay NFC:

- Download and Install the App: If you haven't already, download the Google Pay app from the Google Play Store. Once downloaded, open the app and follow the on-screen instructions to get started.

- Add a Payment Method: To add a payment method, navigate to the "Payment" section within the app. Tap on "Add a payment method" and choose the type of card you want to add. You can either scan your card using your phone’s camera or enter the details manually.

- Verify Your Card: After entering your card details, your bank may require verification. This can be done via a one-time password sent to your registered mobile number or through your bank’s app.

- Enable NFC: Ensure that NFC is enabled on your device. This can usually be found in the "Connections" or "Network & Internet" settings on your phone. Simply toggle the NFC switch to "On."

- Set Google Pay as Default Payment App: For seamless transactions, set Google Pay as your default payment application. This can typically be done in the "Tap & pay" section under settings.

Once these steps are completed, you're all set to make contactless payments with ease. With Google Pay NFC set up, you are ready to enjoy the benefits of fast and secure transactions, streamlining your shopping experience.

How Google Pay NFC Transactions Work

Understanding how Google Pay NFC transactions work can provide insights into the seamless nature of contactless payments. At its core, Google Pay uses Near Field Communication (NFC) technology, which allows devices to communicate over short distances. This enables swift and secure transactions by merely tapping your phone at compatible payment terminals.

Here’s how a typical Google Pay NFC transaction unfolds:

- Initiating the Transaction: Once you’re ready to pay, ensure your phone screen is on and unlocked. Open the Google Pay app, or simply hold your phone near the NFC terminal if Google Pay is set as your default payment method.

- Device and Terminal Interaction: The NFC chip in your phone interacts with the payment terminal’s NFC reader. This process is instantaneous and requires no direct contact, making it highly convenient.

- Authentication and Encryption: Google Pay adds an extra layer of security by using tokenization. Instead of transmitting your actual card details during a transaction, a virtual account number is shared with the merchant, keeping your sensitive information secure.

- Transaction Completion: Once authenticated, the payment terminal will confirm the transaction. You’ll often hear a beep or see a confirmation message on the terminal and your phone, indicating that the payment is successful.

One of the key benefits of Google Pay NFC is its speed and simplicity, reducing checkout times and eliminating the need to handle cash or cards. Its robust security measures, including encryption and tokenization, ensure that your financial information remains protected. Embrace the future of payments with Google Pay NFC, where transactions are not only quick but also secure.

Security Features of Google Pay NFC

When it comes to digital transactions, security is paramount, and Google Pay NFC is designed with robust features to protect your financial data. By leveraging multiple layers of security, Google Pay ensures that your information remains safe throughout the transaction process.

Tokenization: At the heart of Google Pay's security is tokenization. Instead of sharing your actual card details during a transaction, Google Pay uses a virtual account number or "token." This token acts as a proxy, ensuring your sensitive card information is never exposed to the merchant. Each token is unique to your device and changes with every transaction, making it nearly impossible for hackers to reuse stolen data.

Encryption: Google Pay employs advanced encryption techniques to safeguard your data. When you tap to pay, the information transmitted between your phone and the payment terminal is encrypted, preventing unauthorized access during the transaction.

Two-Factor Authentication: For added security, Google Pay supports two-factor authentication (2FA). This means that even if someone gains access to your phone, they’ll need to pass an additional layer of verification, such as a fingerprint or PIN, to authorize payments.

Device-Specific Protections: Google Pay is also linked to your device's security settings. This means that if your device is lost or stolen, your payment information cannot be accessed without unlocking your phone. You can also remotely lock or erase your device using "Find My Device" in case of theft.

With these features, Google Pay NFC not only offers a convenient payment solution but also ensures that your transactions are fortified with cutting-edge security measures. Embrace the peace of mind that comes with knowing your financial data is protected by Google Pay's sophisticated security infrastructure.

Advantages of Using Google Pay NFC

Adopting Google Pay NFC as your preferred payment method comes with a plethora of advantages that make it an appealing choice for both consumers and merchants. The convenience and efficiency it offers are just the tip of the iceberg.

Speed and Convenience: One of the most significant benefits of using Google Pay NFC is the speed of transactions. With just a simple tap, you can complete a payment within seconds, eliminating the need to fumble with cash or cards. This not only saves time but also makes the checkout process smoother and more efficient.

Global Acceptance: Google Pay NFC is widely accepted at numerous merchants worldwide. Whether you’re buying groceries, dining at a restaurant, or shopping online, you’ll find that many places support this contactless payment method, making it a versatile option for consumers.

Enhanced Security: As discussed in the previous section, Google Pay’s security features provide peace of mind. You can enjoy the convenience of digital payments without compromising on the safety of your financial data.

Seamless Integration: Google Pay NFC seamlessly integrates with various loyalty programs and offers. This means you can automatically apply discounts or earn rewards points without having to carry multiple cards or remember login details.

Environmental Impact: By reducing the reliance on physical cards and cash, Google Pay NFC contributes to a decrease in the use of plastic, supporting eco-friendly practices.

Incorporating Google Pay NFC into your daily routine not only enhances your payment experience but also supports a more organized and secure way of managing finances. Ready to take your business to the next level? Get your Ninja Pop now! and capitalize on the advantages of NFC technology.