In today's digital era, the question "does Google Pay use NFC" is quite pertinent as more people seek seamless payment solutions. Google Pay, a leading mobile payment service, indeed harnesses the power of Near Field Communication (NFC) technology to facilitate swift and secure transactions. NFC is a short-range wireless technology that allows two devices to communicate when they are in close proximity, typically a few centimeters apart.

Google Pay leverages NFC to enable contactless payments, allowing users to make purchases by simply holding their smartphone near a compatible payment terminal. This process is not only quick but also ensures a higher level of security compared to traditional methods. NFC technology encrypts transaction data, making it challenging for unauthorized entities to intercept sensitive information.

The integration of NFC in Google Pay has revolutionized the way consumers engage in digital transactions, providing a level of convenience that is unmatched. Users can add their credit or debit card information to the Google Pay app, and with a tap, they are ready to shop without the need for physical cards.

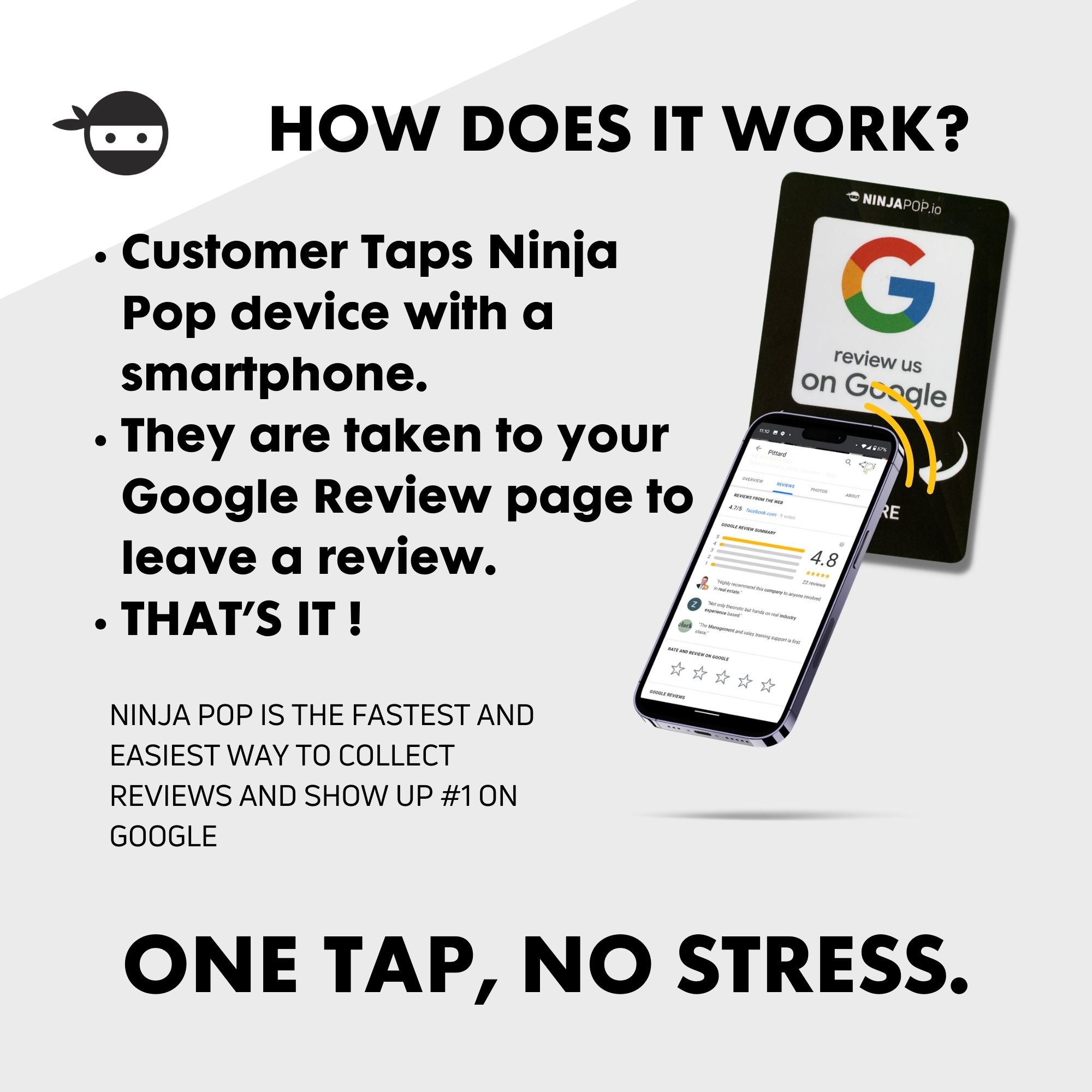

Embrace the innovation in payment technology and ensure your business stays ahead in the digital landscape. Get your Ninja Pop now! and discover how NFC-enabled devices can transform customer interactions into a seamless experience.

How NFC Enables Google Pay Transactions

The backbone of Google Pay's success in the realm of contactless payments is its use of NFC technology. This ingenious technology enables Google Pay to perform transactions that are both quick and secure, reshaping the way consumers interact with payment systems. But how exactly does NFC power Google Pay transactions?

When you initiate a payment with Google Pay, your smartphone's NFC chip communicates with the payment terminal's NFC reader. This interaction is instantaneous, as the devices exchange encrypted data to authorize the transaction. The process involves the transmission of minimal information necessary for the transaction, ensuring that your sensitive card details are not exposed.

Moreover, NFC technology supports the use of dynamic authentication protocols. Each transaction generates a unique code, further enhancing security by making it difficult for potential fraudsters to replicate or intercept the transaction details. This dynamic aspect of NFC ensures that even if data were to be intercepted, it would be virtually useless to the interceptor.

Another significant advantage of using NFC with Google Pay is the elimination of the need for physical contact. This feature not only speeds up the transaction process but also contributes to a hygienic, touch-free payment experience, which is increasingly important in today's health-conscious world.

As NFC technology continues to evolve, its role in enhancing payment security and convenience will only grow, making it an indispensable component of modern digital transactions. Understanding how NFC enables Google Pay transactions offers insight into the future of seamless payment interactions.

Advantages of Using NFC with Google Pay

Utilizing NFC technology with Google Pay offers a multitude of advantages that extend beyond just the ease of use. This powerful combination is at the forefront of transforming the way we handle payments, providing benefits that are both immediate and long-lasting.

One of the most significant advantages is the **increased speed and convenience** that NFC provides. With a simple tap of your smartphone, transactions are completed in seconds, eliminating the need to fumble with cards or cash. This rapid interaction not only enhances customer satisfaction but also reduces queue times, making it a win-win for both consumers and businesses.

Security is another cornerstone of NFC technology. Google Pay leverages NFC's secure communication capabilities to protect user data during transactions. Each payment uses a unique transaction code, ensuring that your actual card details remain hidden from the merchant. This layer of security is crucial in safeguarding against potential fraud and unauthorized access.

NFC's versatility is also noteworthy. It is not limited to point-of-sale transactions; it can be used for a variety of applications including transit passes, access control, and more. This flexibility makes NFC a valuable tool in the digital wallet ecosystem, offering users a comprehensive solution for various needs.

Additionally, NFC-enabled Google Pay is environmentally friendly, as it reduces the reliance on physical cards and paper receipts. This aspect aligns with the growing consumer preference for sustainable practices and technology-driven solutions.

Embracing NFC with Google Pay not only modernizes the payment experience but also enhances it with speed, security, and sustainability, paving the way for a smarter and more efficient financial future.

Security Features of Google Pay NFC Transactions

When it comes to digital transactions, *security* is paramount, and Google Pay's NFC transactions are designed with cutting-edge security measures to ensure user safety. The integration of NFC technology into Google Pay significantly enhances the security framework, making it a trusted choice for countless users worldwide.

One of the primary security features of Google Pay's NFC transactions is the use of tokenization. Instead of transmitting your actual card number during a transaction, Google Pay generates a unique token, which is a randomly assigned number that represents your card. This means that your real card details remain confidential, even if the data is intercepted during the transaction process.

Additionally, Google Pay employs device-specific encryption. This ensures that only the device which initiated the payment can complete the transaction. Even if someone were to gain access to the transaction data, they would not be able to use it without the original device, adding an extra layer of security.

Another important aspect is the requirement of *authentication* for every purchase. Users must unlock their device using a PIN, fingerprint, or facial recognition before making a payment, ensuring that even if a device is lost or stolen, unauthorized transactions cannot occur without the owner's biometric or password verification.

Google Pay also monitors transactions in real-time, utilizing advanced algorithms to detect and flag suspicious activities. This proactive approach helps prevent fraudulent transactions before they can occur, providing users with peace of mind.

Overall, the security features integrated into Google Pay's NFC transactions ensure that users can enjoy the convenience of digital payments without compromising on safety. This robust security infrastructure is a testament to Google Pay’s commitment to protecting its users' financial information.

Setting Up and Using Google Pay with NFC

Getting started with Google Pay using NFC is a straightforward process that allows you to enjoy seamless and secure transactions. Whether you're new to digital payments or looking to enhance your payment experience, setting up Google Pay with NFC is designed to be user-friendly, ensuring that everyone can benefit from its advanced features.

To begin, download the Google Pay app from the Google Play Store or the Apple App Store, depending on your device. Once installed, open the app and sign in with your Google account. If you don't have one, you can easily create a new account within the app.

Next, add your preferred payment method by selecting "Add a payment method" from the menu. You can choose from credit or debit cards from a wide range of banks and financial institutions. Simply follow the on-screen instructions to enter your card details or scan your card using your device's camera for a quicker setup.

After adding your card, Google Pay will verify your information. This may involve a quick authorization process through your bank, ensuring that your account is linked securely. Once verified, your card will be ready for NFC transactions.

Using Google Pay with NFC is as simple as unlocking your device and holding it near a contactless payment terminal. The NFC technology will automatically initiate the transaction, and you'll receive a confirmation on your screen once the payment is successful. Thanks to the built-in security features, including tokenization and biometric authentication, each transaction is protected, allowing you to shop with confidence.

For added convenience, you can also use Google Pay to store loyalty cards, gift cards, and even transit passes, making it a versatile tool for various payment needs. With just a few steps, you can transform your smartphone into a powerful, all-in-one payment solution.

Future of NFC in Mobile Payments

As the landscape of digital payments continues to evolve, the role of NFC technology in mobile payments is set to expand significantly. NFC, or Near Field Communication, has already revolutionized the way we conduct transactions, providing a fast, secure, and convenient method for making payments on the go. As smartphones become increasingly integral to our daily lives, the future of NFC in mobile payments looks promising, with several exciting developments on the horizon.

One of the key trends shaping the future of NFC is its integration with the Internet of Things (IoT). With more devices becoming NFC-enabled, the potential for NFC to facilitate seamless interactions between various smart devices and payment systems is enormous. This could lead to innovations such as smart home payments, where NFC technology allows you to pay for utilities just by interacting with your smart home devices.

Furthermore, as security remains a paramount concern for consumers, NFC technology continues to advance with enhanced security protocols. The use of tokenization and biometric authentication will likely become even more sophisticated, ensuring that mobile payments are not only convenient but also highly secure. This will bolster consumer confidence and encourage wider adoption of NFC-based payment systems globally.

Moreover, the expansion of NFC into emerging markets presents a unique opportunity for growth. As more regions embrace digital payment solutions, the accessibility and affordability of NFC technology will play a crucial role in driving financial inclusion, offering people a reliable alternative to traditional banking methods.

The future of NFC in mobile payments is bright, and businesses can harness this opportunity to enhance their payment solutions. With innovations continually emerging, now is the perfect time to integrate NFC technology into your business model. Get your Ninja Pop now and stay ahead in the digital payment revolution, leveraging the full potential of NFC to drive customer satisfaction and business success.